- Case-Based Roundtable

- General Dermatology

- Eczema

- Chronic Hand Eczema

- Alopecia

- Aesthetics

- Vitiligo

- COVID-19

- Actinic Keratosis

- Precision Medicine and Biologics

- Rare Disease

- Wound Care

- Rosacea

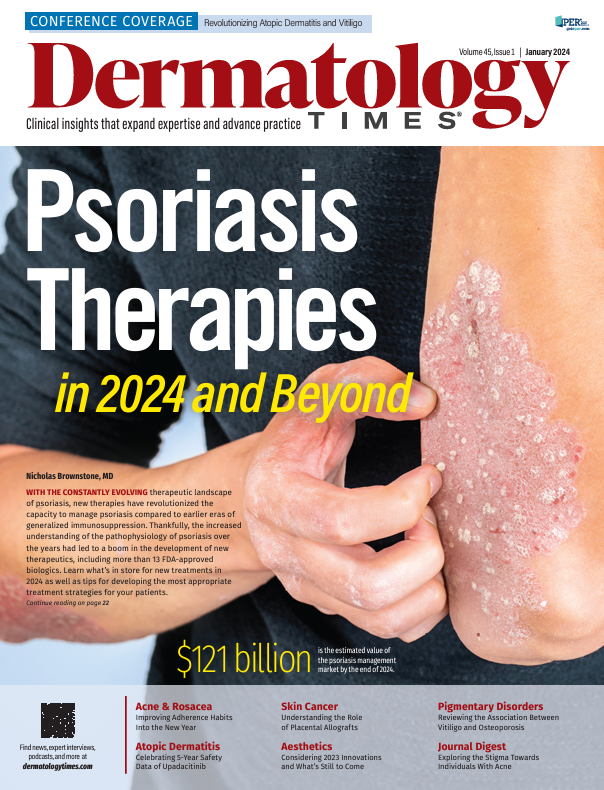

- Psoriasis

- Psoriatic Arthritis

- Atopic Dermatitis

- Melasma

- NP and PA

- Skin Cancer

- Hidradenitis Suppurativa

- Drug Watch

- Pigmentary Disorders

- Acne

- Pediatric Dermatology

- Practice Management

- Prurigo Nodularis

- Buy-and-Bill

News

Article

Dermatology Times

New Year Report Card for Dermatologists and Their Practices

Author(s):

This article delves into 5 critical areas that dermatologists should focus on for a comprehensive 2024 report card.

The start of a new year is a pivotal moment for dermatologists to pause and evaluate both personal and professional financial health. Taking time for introspection and planning offers an opportunity to grade and enhance your financial wellness. This article delves into 5 critical areas that dermatologists should focus on for a comprehensive 2024 report card.

Examine Malpractice Coverage and Implement Other Tools to Protect Assets

Malpractice Insurance

In a profession with high liability exposure, adequate malpractice insurance is your first line of defense. Medical malpractice insurance is a fundamental form of coverage that physicians and other health care professionals rely on to mitigate legal and financial risks.

Medical malpractice policies typically provide financial protection in the form of defense costs, settlements, and judgments arising from malpractice claims within policy limits. To ensure they have the appropriate coverage for their specialties and unique situations, physicians should understand the features and benefits, coverage limits, and key exclusions of their current malpractice insurance or any policy they are evaluating. They should also know the key differences between the 2 main types of policies: claims-made and occurrence-based policies.

Asset Protection Strategies

A properly designed malpractice insurance policy is only one component of a doctor’s comprehensive asset protection plan, designed to position a physician’s assets to make it difficult and in certain cases nearly impossible for a plaintiff from a future lawsuit to access them. A well-executed asset protection plan should combine malpractice and other types of insurance with legal tools, such as trusts and limited liability companies (LLCs), as well as exempt assets to shield personal and practice assets from potential litigation risks. An annual checkup to evaluate insurance policies, legal tools, and exempt assets can ensure that the dermatologist has a cost-effective, robust defense in place.

Revisit a Long-Term Financial Plan and Incorporate Changes in Personal Life

Change is the only constant in life, and many changes can have a dramatic effect on your financial wellness. Hence, your financial plan should be flexible enough to adapt to life’s unpredictability.

The start of a new year is an optimal time to reflect on modifications in your personal circumstances that have occurred during the previous year and work with your financial adviser to assess their impact on your financial plan. Your employment, health, marital status, family size, primary residence, spending, and long-term financial goals are all factors that may be different from the past year, and these variations should be incorporated into your dynamic financial plan.

Changes in outside factors such as market performance and tax rates may be impossible to predict or control but can still have a significant impact on a dermatologist’s finances. An experienced adviser can monitor these changes and offer asset diversification and tax planning strategies to minimize long-term negative effects.

Check Coverage Amounts and Premiums for Disability and Life Insurance Policies

Disability Insurance

Given the substantial investment in your career, protecting your future income is paramount. The onset of disability can lead to significant financial turmoil, often more distressing than premature death. Regularly reviewing your disability insurance ensures it aligns with your current income and lifestyle needs. Consider factors such as benefit amount, waiting period, coverage duration, and the definition of disability when assessing policies.

Life Insurance

Assessing your life insurance coverage is essential to ensure your dependents would be financially secure in your absence. Whether the death benefit must cover a mortgage or education expenses or simply maintain your family’s lifestyle, choosing the right policy type (term or permanent) and coverage amount is vital. In addition, given the tax and asset protection benefits that a permanent (or cash value) life insurance product can provide, the new year is a good time to evaluate this asset class and see whether it fits into your long-term planning.

When conducting an annual review and analysis, it is paramount that you work with an expert and experienced adviser. This professional can help you determine whether changes in personal circumstances, such as marital status or family size, require an adjustment to coverage amount. They can also recommend changes in policy type and/or insurance carrier that could result in more cost-effective premiums and better alignment with long-term financial goals.

Consider the Corporate Structure for Your Practice to Optimize Tax Efficiency

Your dermatology practice’s corporate structure significantly affects tax obligations and operational efficiency. Whether your practice is legally structured as an LLC or a corporation, the tax treatment you select can offer certain benefits and opportunities for tax savings along with disadvantages and restrictions. All medical practices that incorporate are taxed as C corporations unless they elect to become an S corporation.

The rules and tax law concerning both types of corporations are beyond the scope of this article. It is important to note that regularly reviewing and possibly revising your practice’s corporate structure and tax treatment can lead to substantial tax savings and improved financial health. Consulting with a tax professional early in the year to find the most beneficial structure for your practice is a wise move.

Review Benefit Plan Options for Individuals and the Practice

For Individuals

Retirement planning should not be static. With changing income and cash flow, it is important to adapt your savings strategies. Consider options such as qualified retirement plans (QRPs) or nonqualified plans that offer flexibility in funding and can adapt to fluctuating incomes.

For the Practice

An annual review of the practice’s benefit offerings is equally important. This includes evaluating health insurance, retirement plans, and other employee benefits. Ensuring that these benefits are competitive and cost-effective can aid in attracting and retaining top talent, which is vital for the success and growth of your practice. The implementation of nonqualified plans in addition to QRPs can be a significant opportunity for the practice owners to reduce taxes while building wealth for retirement.

Conclusion

Creating a new year report card is more than just a financial exercise; it is a strategic approach to ensure the long-term success and stability of your dermatology practice and personal finances. By focusing on these 5 areas, you can set a strong foundation for the year ahead, adapt to changes, and move closer to achieving your financial goals. Remember, the best plans are those that evolve with you, reflecting changes in your personal and professional life. Here’s to a prosperous and secure 2024!

David B. Mandell, JD, MBA, is an attorney and author of more than a dozen books for doctors, including Wealth Planning for the Modern Physician. He is a partner in the wealth management firm OJM Group (www.ojmgroup.com).

Disclosure

OJM Group, LLC (“OJM”) is a US Securities and Exchange Commission (SEC)–registered investment adviser with its principal place of practice in the state of Ohio. SEC registration does not constitute an endorsement of OJM by the SEC nor does it indicate that OJM has attained a particular level of skill or ability. OJM and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisers by those states in which OJM maintains clients. OJM may only transact practice in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. For information pertaining to the registration status of OJM, please contact OJM or refer to the Investment Adviser Public Disclosure website www.adviserinfo.sec.gov.

For additional information about OJM, including fees and services, send for our disclosure brochure as set forth on Form ADV using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

This article contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized legal or tax advice or as a recommendation of any particular security or strategy. There is no guarantee that the views and opinions expressed in this article will be appropriate for your particular circumstances. Tax law changes frequently; accordingly, information presented herein is subject to change without notice. You should seek professional tax and legal advice before implementing any strategy discussed herein.